Introduction

The tax code is complex, but as a realtor, you have access to a range of tax deductions that can help you save money and reduce your tax bill. By taking advantage of these deductions, you can maximize your tax savings and keep more of your hard-earned money. In this article, we'll explore some of the essential tax deductions every realtor should know about in 2026.

Disclaimer: This article is for informational purposes only and should not be construed as tax advice. Please consult with a qualified tax professional to determine which deductions apply to your specific situation.

Home Office Deduction

If you use a portion of your home exclusively for business purposes, you may be eligible for the home office deduction. This deduction allows you to deduct a portion of your home-related expenses, such as mortgage interest, property taxes, utilities, and insurance, based on the percentage of your home that is used for business.

To qualify for the home office deduction, you must meet the following criteria:

- ⭐ Exclusive Use: The space must be used exclusively for business purposes. This means the area cannot be used for any personal activities.

- ♻️ Regular Use: The space must be used regularly for business activities, such as on a continuous, ongoing, or recurring basis.

- 🥇 Principal Place of Business: The space must be your principal place of business or used to meet with clients or customers in the normal course of your trade or business, what this means is that you can't have another office outside of your home that you use more frequently.

- 💼 Self-Employment: As of 2024, only self-employed individuals can claim the home office deduction. This includes independent contractors, sole proprietors, and freelancers.

Eligible expenses for the home office deduction include:

- 🏠 Mortgage Interest or Rent: You can deduct a portion of your mortgage interest or rent based on the percentage of your home that is used for business.

- 🏷️ Property Taxes: You can deduct a portion of your property taxes based on the percentage of your home that is used for business.

- 💡 Utilities: You can deduct a portion of your utilities, such as electricity, water, and internet, based on the percentage of your home that is used for business.

- 🛡️ Insurance: You can deduct a portion of your homeowners or renters insurance based on the percentage of your home that is used for business.

- 🔧 Repairs and Maintenance: You can deduct a portion of your repairs and maintenance expenses, such as painting, plumbing, and landscaping, based on the percentage of your home that is used for business.

Mileage and Vehicle Expenses

As a realtor, you can deduct expenses related to using your vehicle for business purposes. For 2024, the standard mileage deduction rate is 67 cents per mile for business use. Alternatively, you can deduct actual vehicle expenses.

There are two methods for calculating vehicle expenses:

- 🚗 Standard Mileage Rate: Simpler method, multiply business miles by the IRS rate.

- 🔧 Actual Expenses: More complex method, track all vehicle expenses and deduct the business portion. This includes gas, oil, repairs, insurance, registration fees, and depreciation.

Marketing and Advertising Expenses

Marketing and advertising expenses are fully deductible as business expenses. This includes costs related to promoting your services, such as:

- 📱 Digital Marketing: Expenses related to online advertising, social media marketing, and email campaigns.

- 🖨️ Print Advertising: Expenses related to print ads, flyers, brochures, and direct mail campaigns.

- 📺 Television and Radio Ads: Expenses related to television and radio commercials.

- 📸 Photography and Videography: Expenses related to professional photography and videography services.

- 🎨 Graphic Design: Expenses related to graphic design services for marketing materials.

Professional Memberships and Licensing Fees

Professional memberships and licensing fees are fully deductible as business expenses. This includes costs related to maintaining your real estate license and memberships in professional organizations, such as:

- 📜 Realtor Associations: Membership fees for local, state, and national realtor associations.

- 📝 MLS Fees: Fees for access to the multiple listing service (MLS).

- 📚 Continuing Education: Costs related to continuing education courses and seminars.

- 📋 Licensing Renewal: Fees for renewing your real estate license.

These expenses are fully deductible as long as they are ordinary and necessary for your real estate business.

Insurance Premiums

Insurance premiums are fully deductible as business expenses. This includes costs related to insurance coverage for your real estate business, such as:

- 🏠 Liability Insurance: Coverage for potential claims against your business.

- 🔑 Errors and Omissions Insurance: Coverage for professional liability claims.

- 🔒 Property Insurance: Coverage for your business property, such as your office or equipment.

- 🚗 Auto Insurance: Coverage for your business vehicles.

- 🌧️ Business Interruption Insurance: Coverage for lost income due to a covered event, such as a natural disaster.

Software and Technology Expenses

Software and technology expenses are fully deductible as business expenses. This includes costs related to software and technology tools that help you run your real estate business, such as:

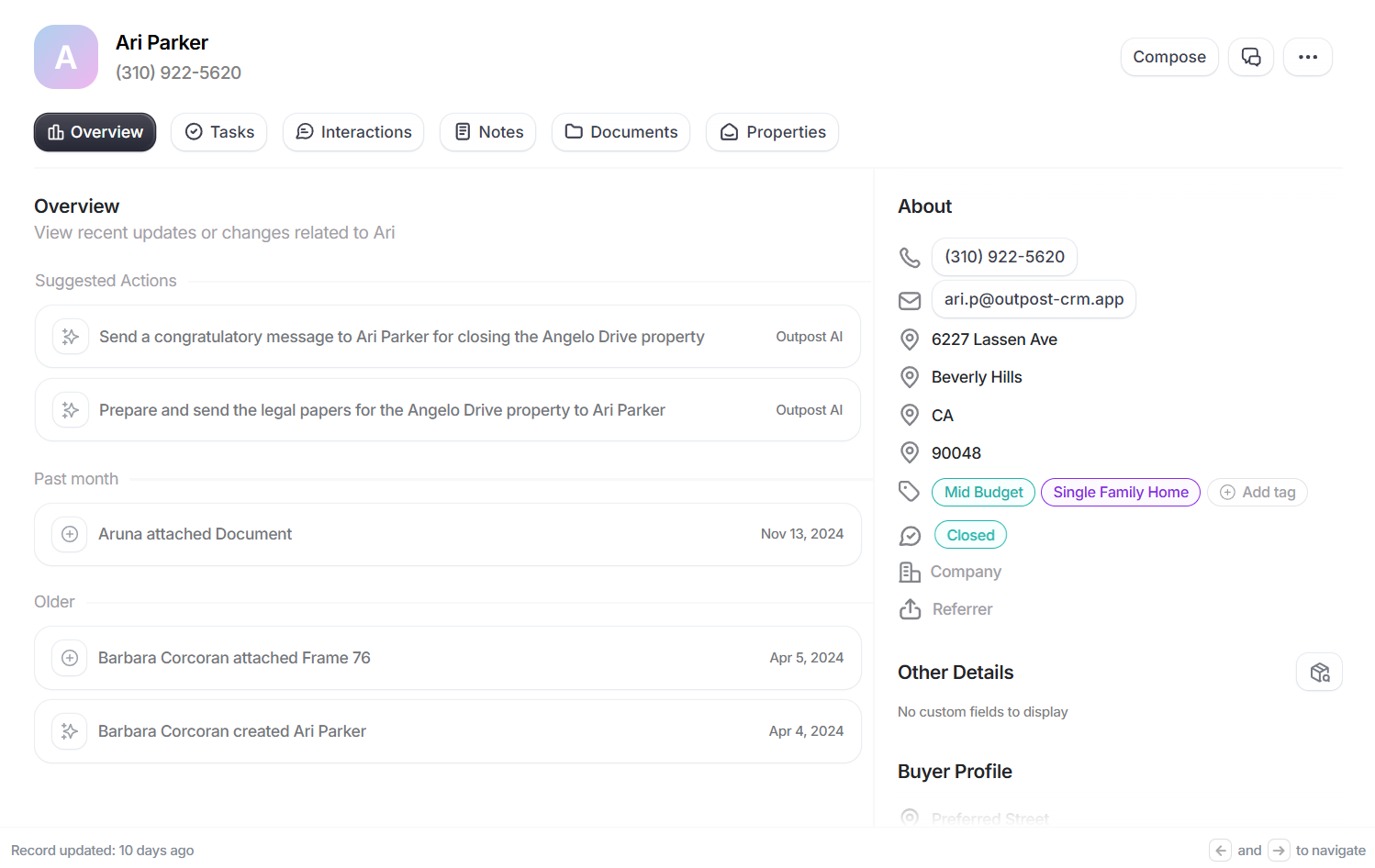

- 🖥️ CRM Software: If you use a CRM like Outpost, you can deduct the cost of the software as a business expense.

- 📧 Email Marketing: Expenses related to email marketing platforms.

- 📱 Mobile Apps: Expenses related to mobile apps for real estate professionals.

- 📊 Analytics Tools: Expenses related to data analytics and reporting tools.

- 🔒 Cybersecurity Software: Expenses related to cybersecurity software to protect your business data.

Travel and Meal Expenses

Travel and meal expenses are partially deductible as business expenses. This includes costs related to business travel and meals with clients, such as:

- 🚆 Business Travel: Expenses related to airfare, lodging, rental cars, and other travel costs.

- 🍽️ Meals: 50% deductible from meal expenses during business travel, such as lunches or dinners.

- 💤 Hotel: Expenses related to hotel stays during business travel.

Conclusion

You don't have to be a tax expert to take advantage of these essential tax deductions. By keeping accurate records and working with a qualified tax professional, you can maximize your tax savings and keep more of your hard-earned money. Remember to consult with a tax professional to determine which deductions apply to your specific situation and take full advantage of the tax benefits available to you as a realtor in 2026.